I'm aware that this has nothing to do with transportation whatsoever, but I'd like to talk about taxes in the United States. I could make a point about how we fund our government plays a major role in how we pay for infrastructure, which is true; in reality I just think this is very important and I only have one blog, so this is where it's going.

Let me just start with an anecdote. About seven years ago I was an employee at Comcast as a cable technician and, during my first few weeks, I was trained by a few different people who'd worked there quite a while. One of them was telling me about how much money you could make as a contractor, relating to me that he'd made just under $75,000 in a prior year, which led to a brief discussion about how he was worried about hitting that $75k threshold and being taxed at a higher rate. Knowing what I did about taxes at that time (i.e., nothing), I took it at face value that if you earned more you would be taxed at a higher rate, and assumed that applied to every cent you earned. So if you paid a higher tax rate above $75k than you did below it, you would actually keep more of your money if you earned $74,999 than if you earned $75,001. It seems kind of unfair, but in a simplistic way it makes perfect sense.

It's also perfectly wrong. Even professional writers have been

shown to be ignorant of this fact. In fact, we have something called a

marginal tax rate for federal income tax in this country, and it's structured such that you only pay a higher tax rate on money earned after a given threshold has been reached. For example, if we had only two tax rates, 10% for earnings under $50k, and 25% for everything above that, it would look like this:

$35k earnings: full amount taxed at 10% = $3,500

$50k earnings: full amount taxed at 10% = $5,000

$51k earnings: $50k taxed at 10% ($5,000) + $1k taxed at 25% ($250) = $5,250

$100k earnings: $50k taxed at 10% ($5,000) + $50k taxed at 25% ($12,500) = $17,500

Play around with the numbers all you like, the takeaway point is that the more you earn in this system, the more money you take home.

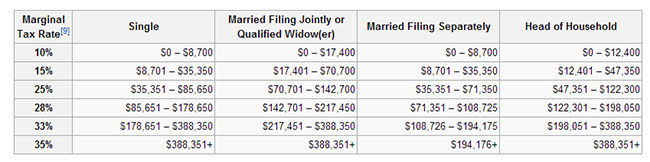

Always. There are diminishing returns on the amount of money you keep as you earn more, but it's impossible to be taxed more than someone with higher earnings than your own. The corollary here is that, ignoring the many exemptions that exist, as well as non-wage income, your average tax rate is always lower than someone who earns more than you. So the people making $35k and $50k pay a tax rate of 10%, the person making $51k pays a tax rate of 10.3% (5,250 divided by 51,000), and the person making $100k pays an averaged rate of 17.5%. This is exactly how our system works, with a greater number of brackets (2012 rates pictured below) so that the tax rate increase from one threshold to the next isn't quite so dramatic.

|

| Federal income tax brackets. From Wikipedia. |

One thing I think it's important to keep in mind when someone says they're paying a certain tax rate is that they're often referring to the highest marginal tax bracket that they pay. So if I earn $150k per year I might say that I'm paying a tax rate of 28%, but that's not actually the case. Instead, my tax rate is calculated as follows:

10% of $8,700 = $870

15% of $26,650 (35,350 minus 8,700) = $3,997.50

25% of $50,300 (85,650 minus 35,350) = $12,575

28% of $64,350 (150,000 minus 85,650) = $18,018

Total tax paid = $35,460.50

Actual tax rate = 23.6%

A 28% tax rate on $150k would come out to $42,000, so while it's not a massive discrepancy between the highest marginal tax rate and actual tax rate, that difference equates to more than $6,500 that they get to hold onto. To get just a little bit political here, this is why I don't find the "it'll hurt small business owners" argument against increasing the rates of the upper brackets convincing: for one,

about 2% of business owners who file their taxes as individuals earn over $250k a year; that point aside, only the income beyond that $250k threshold (or other arbitrary amount) would be subject to the increased rates. And since high earners still get the benefit of all those sub-$250k tax cuts, they still get a bigger tax cut than anyone else. Passing up hundreds of billions of dollars in revenue just for the sake of this tiny group of business owners--people who are just as free to use that extra money on a

fancy rug as on expanding their business or hiring new employees--seems very foolish to me when we're supposedly so concerned about our nation's debt and the insolvency of our entitlement programs.

Moving on: federal income taxes aren't the only taxes we pay, of course. There are property taxes which everyone pays (including renters, since this cost is generally passed on by the owner), as well as sales taxes, capital gains taxes, gas taxes, and income taxes for many states (on top of federal income taxes). And we have payroll taxes, the other tax that shows up on your actual paycheck. On the employee side, we pay 6.2% of our income for Social Security, and another 1.45% for Medicare. Social Security taxes are only collected on the first $110,000 of taxable income as of 2012, so earnings beyond that are only subject to federal income tax and the 1.45% Medicare tax.

Keeping the Social Security tax exemption for income over $110,000 in mind, let's calculate the total tax rate for three different incomes. I'll just give you the total amount of taxes paid (summing income tax, SS tax, and Medicare tax) and the actual total tax rate:

$110k income = $32,675.50 taxes = 29.71% tax rate

$150k income = $44,455.5 taxes = 29.64% tax rate

$300k income = $94,698 taxes = 31.57% tax rate

Uh oh, we broke it. Why is $150k-person paying a lower rate than $110k person? The answer is that the person earning $200k is paying exactly the same dollar amount in Social Security taxes, but since their income is higher their

effective payroll tax rate is much lower than the rate of the person earning $110k. Once we get up to $300k we see that we're back in "higher earnings = higher tax rate" territory, although it might be reasonable to ask why the person earning almost three times as much as the $110k guy is paying a rate that isn't even 2% higher. For comparison, the jump from roughly $35k to $85k in earnings is commensurate with an effective tax rate increase of almost 7 percentage points:

$35,350 income = $7,571.78 taxes = 21.42% tax rate

$85,650 income = $23,994.73 taxes = 28.01% tax rate

Someone increasing their income from $35k to $85k is experiencing a much more significant and positive change in their quality of life and financial circumstances, and yet it seems that we're penalizing them more for this improvement than we are for someone jumping from $110k to $300k. Of course the point of taxes is not to punish people for earning money, and rather to fund government services of various kinds, but we should also be honest about the fact that taxes discourage the activity that they're tied to. This is more obvious with things like cigarette and gas taxes, but it also has some small impact on how much time people devote to work versus leisure. Why we are applying that discouraging tax rate increase more forcefully on those raising themselves from middle-class to upper-middle-class than we are from people moving from upper-middle-class to upper-class is something of a mystery to me. Weren't we supposed to be champions of the middle class?

You've probably figured out by now that I don't have any particular point I'm trying to make here. Hopefully you learned a little something about how the United States tax system works, and maybe have a slightly different perspective than you did before (or maybe a radically different one!). It's important that we do more than complain about the things we don't particularly like (i.e., taxes) and instead make an effort to better understand them and make educated decisions about how they should be changed. Maybe lower taxes are a good idea, but "lower taxes" doesn't tell us anything about who's paying less, how much less they're paying, or whether some people might be paying more to afford it. Additionally, how our institutions are organized is important. People will always argue about appropriate tax rates, but few would disagree that things aren't working properly when someone earning $150k a year pays a lower tax rate than another person earning $110k without even taking advantage of any of the numerous loopholes found in our tax system (which would take much more than this one post to discuss). Conversely, the advantages of a marginal tax rate system are self-evident: in actual dollars, people shouldn't pay more taxes than someone earning more than them.

If this post left any questions unanswered for you please let me know in the comment section. Chances are that I won't know the answer off-hand, but in the spirit of Better Institutions I'll be happy to learn the answer for myself and pass it along.