twitter and link

Follow my transportation/infrastructure Twitter feed at PCNTransit, and my transportation blog at Better Institutions

Thursday, January 17, 2013

"Unpaid, full-time internship"

Things like this really piss me off:

"U.S. Sen. Bill Nelson of Florida is accepting applications for an unpaid, full-time press internship this spring in Washington, D.C."

Who is actually in a position to take an unpaid, full-time internship? People with rich parents, and no one else. If that's not you, you have the following options:

1. Spend several years working lower-level or only tangentially-related jobs until you've got the required experience to find a job similar to the internship that actually pays you, but be several years behind the rich person who was able to take that internship.

2. Take the unpaid, full-time internship and get a second full-time job elsewhere so you can actually pay for rent, food, bills, etc. Hopefully that unpaid internship is only 40 hours a week (unlikely) and even if it is, good luck performing your best at either job working 80 hours a week.

3. Don't bother going into a super-ambitious field, because almost all of them require a lot of unpaid time spent "gaining experience" and "demonstrating commitment", and you simply don't have the extra time to spend on it.

It's possible to be successful in life despite your circumstances--examples abound--but above average intelligence + above average work ethic + below average socioeconomic status often equals average success, at best. It shouldn't require brilliance to succeed despite one's background, nor should average qualities lead to outstanding success because of a privileged background, but that's still the way our system is set up.

Tuesday, November 20, 2012

Here's one way to have a more equitable federal income tax system

Politically, tax reform is a difficult thing to do. In terms of actual policy though, not so much. Here's just one example of how we can achieve a much more equitable tax structure without hurting lower- and middle-income Americans:

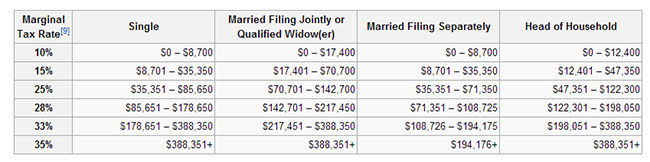

- Don't change the existing tax rates. Below is an image of our current marginal tax rates.

|

| From Wikipedia. |

- Add two new tax brackets: 40% for income above $1 million per year, and 45% for income above $5 million per year. Remember, this means that only income those thresholds is taxed at that amount--this does not discourage people from reaching these thresholds (at least, not if they understand how marginal tax rates work).

- Limit deductions for all individuals to ~$20,000 ($40k or less for couples), excluding charity and retirement investment. This means no excessive subsidies for "cadillac" health care plans, no writing off mortgage interest and property tax for multi-million dollar homes. The employer health care deduction is no longer necessary after Obamacare and should instead be offered to the employees themselves, and mortgage interest deductions primarily benefit the rich and are unnecessary to promote homeownership anyway. Charity is excluded because it's generally contrary to American values to discourage charity; retirement investment would not be subject to the $20k limit, although it would probably be sensible to limit it such that the very highest earners weren't receiving the bulk of the savings. Taking a look at our top tax expenditures, I estimate this would increase revenue by about $100-200 billion per year without negatively affecting anyone in the middle class (or very, very few). Limiting these deductions also ensures that people making similar incomes actually pay similar amounts of taxes, in lieu of all the distorting loopholes.

- Institute the Buffett Rule, slightly modified. Rather than limiting it to ensuring that people earning $1 million or more pay at least a 30% federal income tax rate, which might actually encourage people to limit their earnings, add a few more brackets. Say, 27% for those earning over $500k, and 25% for earnings over $300k. This takes care of people who earn the bulk of their money via investment and therefore pay at the 15% capital gains rate. It might also be reasonable to make a few brackets above 30%, like for example a 35% rate over $5 million.

That's it. The details are obviously negotiable. The principles behind this are: a) to ensure that the very rich are paying more, since it really makes no sense for someone earning $300k to pay the same rate as someone earning $10 million; b) to ensure that those earning less than ~$100k per year are not paying more as a result of these changes, and the deduction limits I proposed can be modified to reflect this; c) to ensure that no one in the upper income brackets is paying a lower rate than middle class Americans.

Republican politicians aside, these are principles that are wildly popular in the United States, and as long as it was made clear that the deduction limits are set highly enough so as not to negatively affect middle-income (or even upper-middle income) Americans, I think it could go over quite well. Besides having the effect of raising, at a very minimum, several hundred billion dollars a year in additional revenue, it gives us a system in which income is actually predictive of tax rate. No longer would we have people earning millions of dollars a year paying lower rates than those earning $50,000 or less, and no longer would the majority of tax expenditures accrue to the affluent.

Comments and criticisms appreciated--if I'm wrong about any of my assumptions, or if you think you've got better ideas about any of this, let me know! There're a million different ways to create a better system than what we're currently stuck with, this is just one possibility.

Tuesday, November 13, 2012

The root of my disagreement with conservatives: lack of nuance in their worldview

This is a really great article by Matthew Yglesias.

It does a good job of describing how I feel about the way many conservatives think without being really offensive to anyone. I tend to take a very nuanced view of most issues (or aspire to, at least), and when I'm arguing with conservatives they tend to stick to a few key points and all the complexity gets tossed aside.

But we live in a world with 7 billion people, and a country with 300 million. There are so many issues to address and focusing on one is certain to have downstream effects on many others, some foreseen, some not. Technology rapidly changes the way we perceive and experience the world. And so on.

The world is not a black and white place, and when we treat it as such our policies end up failing a great many people, whether it's intentional or not.

It does a good job of describing how I feel about the way many conservatives think without being really offensive to anyone. I tend to take a very nuanced view of most issues (or aspire to, at least), and when I'm arguing with conservatives they tend to stick to a few key points and all the complexity gets tossed aside.

But we live in a world with 7 billion people, and a country with 300 million. There are so many issues to address and focusing on one is certain to have downstream effects on many others, some foreseen, some not. Technology rapidly changes the way we perceive and experience the world. And so on.

The world is not a black and white place, and when we treat it as such our policies end up failing a great many people, whether it's intentional or not.

Thursday, November 8, 2012

Analysis: Jay Inslee will win election for Washington state governor

Statewide, Jay Inslee currently leads Rob McKenna in votes, 51.06% to

48.94%. Inslee currently leads by slightly more than 50,000 votes.*

Out of the 637,000 uncounted ballots on hand, 244,000 are in King

County. Being very generous to McKenna and assuming 40% of the remaining votes

in King County break for him, that gives Inslee 146,400 more and McKenna 97,600

more, or 48,800 more for Inslee.

That would put Inslee ahead by 98,800, with 393,000 ballots remaining

to be counted in the other counties.

To win 98,800 more votes of the remaining 393,000, McKenna would have

to win at least 62.6% of those votes. (62.6% of 393,000 = 246,018; leaving

Inslee with 146,982; 246,018 - 146982 = 99,036.) The math equation used to find

the percentage required is the following, for those interested:

393000x - 393000(1-x) > 98,800

x > 0.626

There are seven other counties that have a majority in favor of Inslee,

and their remaining uncounted ballots add up to 122,060. 80,000 of these are in

Snohomish, however, for which McKenna got 52.6% of the most recent batch. So

let's be very generous to McKenna once again and assume that McKenna gets a

full 53% of ALL of those ballots in counties that are currently pro-Inslee overall.

This gives him 64,691 votes to Inslee's 57,368. So McKenna gains 7,323 votes

relative to Inslee.

Since after counting King County McKenna was behind by 98,800, the

above ballots put him behind by 91,477 votes, with about 270,940 ballots left

to count. Using the same equation as above, we find that McKenna now needs

66.9% of the remaining vote to pull off a win. Can he do it?

There are six counties that have so far voted for McKenna at a

percentage equal to or greater than 66.9%: Grant (68.66%), Douglas (67.39%),

Lincoln (70.07%), Adams (70.88%), Columbia (70.65%), and Garfield (73.91%).

These are all very low population counties, and their uncounted ballots total

5,863.

By comparison, counties that support McKenna by 55% or less have a

total of 157,070 uncounted ballots remaining. Notice that the difference

between McKenna's BEST county, Garfield (73.91%), and the average percentage he

needs to pull in, 66.9%, is only 7%. In comparison, the difference between 66.9

and 55% is almost 12 points. The total number of votes that fall into the

sub-55% category, and their distance from 66.9%, make it very unlikely for votes in more supportive counties to make up this shortfall.

I think I’ve driven this point home quite enough, but let’s go just a

bit further to really make sure it sticks. If we give McKenna a full 55% of

those remaining ballots in the counties

that are pro-McKenna by 55% or less, he would get 86,389 to Inslee’s 70,681,

for a gain of 15,708. That puts him behind by 75,769 votes with 113,870 left to

count.

Doing our little calculation one last time, we find that McKenna would

have to win 83.3% of the remaining votes, 10% higher than his best county and

roughly 20-25% higher than the average of those still not accounted for.

To jump back and be even more generous to McKenna, even if we gave him 45% of the remaining votes in King County he would still be trailing by 51,000 with 113,870 left to count in his most supportive counties. To overcome this deficit would require that 72.4% of those votes go for McKenna. Given that only one small county has achieved a higher percentage than that, and that at least 45,000 of the remaining votes are in counties that support McKenna by less than 60%, this becomes as close to impossible as a person can safely say without testing the wrath of God.

To jump back and be even more generous to McKenna, even if we gave him 45% of the remaining votes in King County he would still be trailing by 51,000 with 113,870 left to count in his most supportive counties. To overcome this deficit would require that 72.4% of those votes go for McKenna. Given that only one small county has achieved a higher percentage than that, and that at least 45,000 of the remaining votes are in counties that support McKenna by less than 60%, this becomes as close to impossible as a person can safely say without testing the wrath of God.

So let me be the first to officially congratulate you, Governor-elect

Jay Inslee! We did it!

*At the time this was being written this was the case. About 30,000 ballots in King County have

since been counted and Inslee now leads by 55,000 votes and is at 51.14%.

How federal taxes work, and sometimes don't

I'm aware that this has nothing to do with transportation whatsoever, but I'd like to talk about taxes in the United States. I could make a point about how we fund our government plays a major role in how we pay for infrastructure, which is true; in reality I just think this is very important and I only have one blog, so this is where it's going.

Let me just start with an anecdote. About seven years ago I was an employee at Comcast as a cable technician and, during my first few weeks, I was trained by a few different people who'd worked there quite a while. One of them was telling me about how much money you could make as a contractor, relating to me that he'd made just under $75,000 in a prior year, which led to a brief discussion about how he was worried about hitting that $75k threshold and being taxed at a higher rate. Knowing what I did about taxes at that time (i.e., nothing), I took it at face value that if you earned more you would be taxed at a higher rate, and assumed that applied to every cent you earned. So if you paid a higher tax rate above $75k than you did below it, you would actually keep more of your money if you earned $74,999 than if you earned $75,001. It seems kind of unfair, but in a simplistic way it makes perfect sense.

It's also perfectly wrong. Even professional writers have been shown to be ignorant of this fact. In fact, we have something called a marginal tax rate for federal income tax in this country, and it's structured such that you only pay a higher tax rate on money earned after a given threshold has been reached. For example, if we had only two tax rates, 10% for earnings under $50k, and 25% for everything above that, it would look like this:

$35k earnings: full amount taxed at 10% = $3,500

$50k earnings: full amount taxed at 10% = $5,000

$51k earnings: $50k taxed at 10% ($5,000) + $1k taxed at 25% ($250) = $5,250

$100k earnings: $50k taxed at 10% ($5,000) + $50k taxed at 25% ($12,500) = $17,500

Play around with the numbers all you like, the takeaway point is that the more you earn in this system, the more money you take home. Always. There are diminishing returns on the amount of money you keep as you earn more, but it's impossible to be taxed more than someone with higher earnings than your own. The corollary here is that, ignoring the many exemptions that exist, as well as non-wage income, your average tax rate is always lower than someone who earns more than you. So the people making $35k and $50k pay a tax rate of 10%, the person making $51k pays a tax rate of 10.3% (5,250 divided by 51,000), and the person making $100k pays an averaged rate of 17.5%. This is exactly how our system works, with a greater number of brackets (2012 rates pictured below) so that the tax rate increase from one threshold to the next isn't quite so dramatic.

One thing I think it's important to keep in mind when someone says they're paying a certain tax rate is that they're often referring to the highest marginal tax bracket that they pay. So if I earn $150k per year I might say that I'm paying a tax rate of 28%, but that's not actually the case. Instead, my tax rate is calculated as follows:

10% of $8,700 = $870

15% of $26,650 (35,350 minus 8,700) = $3,997.50

25% of $50,300 (85,650 minus 35,350) = $12,575

28% of $64,350 (150,000 minus 85,650) = $18,018

Total tax paid = $35,460.50

Actual tax rate = 23.6%

A 28% tax rate on $150k would come out to $42,000, so while it's not a massive discrepancy between the highest marginal tax rate and actual tax rate, that difference equates to more than $6,500 that they get to hold onto. To get just a little bit political here, this is why I don't find the "it'll hurt small business owners" argument against increasing the rates of the upper brackets convincing: for one, about 2% of business owners who file their taxes as individuals earn over $250k a year; that point aside, only the income beyond that $250k threshold (or other arbitrary amount) would be subject to the increased rates. And since high earners still get the benefit of all those sub-$250k tax cuts, they still get a bigger tax cut than anyone else. Passing up hundreds of billions of dollars in revenue just for the sake of this tiny group of business owners--people who are just as free to use that extra money on a fancy rug as on expanding their business or hiring new employees--seems very foolish to me when we're supposedly so concerned about our nation's debt and the insolvency of our entitlement programs.

Moving on: federal income taxes aren't the only taxes we pay, of course. There are property taxes which everyone pays (including renters, since this cost is generally passed on by the owner), as well as sales taxes, capital gains taxes, gas taxes, and income taxes for many states (on top of federal income taxes). And we have payroll taxes, the other tax that shows up on your actual paycheck. On the employee side, we pay 6.2% of our income for Social Security, and another 1.45% for Medicare. Social Security taxes are only collected on the first $110,000 of taxable income as of 2012, so earnings beyond that are only subject to federal income tax and the 1.45% Medicare tax.

Keeping the Social Security tax exemption for income over $110,000 in mind, let's calculate the total tax rate for three different incomes. I'll just give you the total amount of taxes paid (summing income tax, SS tax, and Medicare tax) and the actual total tax rate:

$110k income = $32,675.50 taxes = 29.71% tax rate

$150k income = $44,455.5 taxes = 29.64% tax rate

$300k income = $94,698 taxes = 31.57% tax rate

Uh oh, we broke it. Why is $150k-person paying a lower rate than $110k person? The answer is that the person earning $200k is paying exactly the same dollar amount in Social Security taxes, but since their income is higher their effective payroll tax rate is much lower than the rate of the person earning $110k. Once we get up to $300k we see that we're back in "higher earnings = higher tax rate" territory, although it might be reasonable to ask why the person earning almost three times as much as the $110k guy is paying a rate that isn't even 2% higher. For comparison, the jump from roughly $35k to $85k in earnings is commensurate with an effective tax rate increase of almost 7 percentage points:

$35,350 income = $7,571.78 taxes = 21.42% tax rate

$85,650 income = $23,994.73 taxes = 28.01% tax rate

Someone increasing their income from $35k to $85k is experiencing a much more significant and positive change in their quality of life and financial circumstances, and yet it seems that we're penalizing them more for this improvement than we are for someone jumping from $110k to $300k. Of course the point of taxes is not to punish people for earning money, and rather to fund government services of various kinds, but we should also be honest about the fact that taxes discourage the activity that they're tied to. This is more obvious with things like cigarette and gas taxes, but it also has some small impact on how much time people devote to work versus leisure. Why we are applying that discouraging tax rate increase more forcefully on those raising themselves from middle-class to upper-middle-class than we are from people moving from upper-middle-class to upper-class is something of a mystery to me. Weren't we supposed to be champions of the middle class?

You've probably figured out by now that I don't have any particular point I'm trying to make here. Hopefully you learned a little something about how the United States tax system works, and maybe have a slightly different perspective than you did before (or maybe a radically different one!). It's important that we do more than complain about the things we don't particularly like (i.e., taxes) and instead make an effort to better understand them and make educated decisions about how they should be changed. Maybe lower taxes are a good idea, but "lower taxes" doesn't tell us anything about who's paying less, how much less they're paying, or whether some people might be paying more to afford it. Additionally, how our institutions are organized is important. People will always argue about appropriate tax rates, but few would disagree that things aren't working properly when someone earning $150k a year pays a lower tax rate than another person earning $110k without even taking advantage of any of the numerous loopholes found in our tax system (which would take much more than this one post to discuss). Conversely, the advantages of a marginal tax rate system are self-evident: in actual dollars, people shouldn't pay more taxes than someone earning more than them.

If this post left any questions unanswered for you please let me know in the comment section. Chances are that I won't know the answer off-hand, but in the spirit of Better Institutions I'll be happy to learn the answer for myself and pass it along.

Let me just start with an anecdote. About seven years ago I was an employee at Comcast as a cable technician and, during my first few weeks, I was trained by a few different people who'd worked there quite a while. One of them was telling me about how much money you could make as a contractor, relating to me that he'd made just under $75,000 in a prior year, which led to a brief discussion about how he was worried about hitting that $75k threshold and being taxed at a higher rate. Knowing what I did about taxes at that time (i.e., nothing), I took it at face value that if you earned more you would be taxed at a higher rate, and assumed that applied to every cent you earned. So if you paid a higher tax rate above $75k than you did below it, you would actually keep more of your money if you earned $74,999 than if you earned $75,001. It seems kind of unfair, but in a simplistic way it makes perfect sense.

It's also perfectly wrong. Even professional writers have been shown to be ignorant of this fact. In fact, we have something called a marginal tax rate for federal income tax in this country, and it's structured such that you only pay a higher tax rate on money earned after a given threshold has been reached. For example, if we had only two tax rates, 10% for earnings under $50k, and 25% for everything above that, it would look like this:

$35k earnings: full amount taxed at 10% = $3,500

$50k earnings: full amount taxed at 10% = $5,000

$51k earnings: $50k taxed at 10% ($5,000) + $1k taxed at 25% ($250) = $5,250

$100k earnings: $50k taxed at 10% ($5,000) + $50k taxed at 25% ($12,500) = $17,500

Play around with the numbers all you like, the takeaway point is that the more you earn in this system, the more money you take home. Always. There are diminishing returns on the amount of money you keep as you earn more, but it's impossible to be taxed more than someone with higher earnings than your own. The corollary here is that, ignoring the many exemptions that exist, as well as non-wage income, your average tax rate is always lower than someone who earns more than you. So the people making $35k and $50k pay a tax rate of 10%, the person making $51k pays a tax rate of 10.3% (5,250 divided by 51,000), and the person making $100k pays an averaged rate of 17.5%. This is exactly how our system works, with a greater number of brackets (2012 rates pictured below) so that the tax rate increase from one threshold to the next isn't quite so dramatic.

|

| Federal income tax brackets. From Wikipedia. |

10% of $8,700 = $870

15% of $26,650 (35,350 minus 8,700) = $3,997.50

25% of $50,300 (85,650 minus 35,350) = $12,575

28% of $64,350 (150,000 minus 85,650) = $18,018

Total tax paid = $35,460.50

Actual tax rate = 23.6%

A 28% tax rate on $150k would come out to $42,000, so while it's not a massive discrepancy between the highest marginal tax rate and actual tax rate, that difference equates to more than $6,500 that they get to hold onto. To get just a little bit political here, this is why I don't find the "it'll hurt small business owners" argument against increasing the rates of the upper brackets convincing: for one, about 2% of business owners who file their taxes as individuals earn over $250k a year; that point aside, only the income beyond that $250k threshold (or other arbitrary amount) would be subject to the increased rates. And since high earners still get the benefit of all those sub-$250k tax cuts, they still get a bigger tax cut than anyone else. Passing up hundreds of billions of dollars in revenue just for the sake of this tiny group of business owners--people who are just as free to use that extra money on a fancy rug as on expanding their business or hiring new employees--seems very foolish to me when we're supposedly so concerned about our nation's debt and the insolvency of our entitlement programs.

Moving on: federal income taxes aren't the only taxes we pay, of course. There are property taxes which everyone pays (including renters, since this cost is generally passed on by the owner), as well as sales taxes, capital gains taxes, gas taxes, and income taxes for many states (on top of federal income taxes). And we have payroll taxes, the other tax that shows up on your actual paycheck. On the employee side, we pay 6.2% of our income for Social Security, and another 1.45% for Medicare. Social Security taxes are only collected on the first $110,000 of taxable income as of 2012, so earnings beyond that are only subject to federal income tax and the 1.45% Medicare tax.

Keeping the Social Security tax exemption for income over $110,000 in mind, let's calculate the total tax rate for three different incomes. I'll just give you the total amount of taxes paid (summing income tax, SS tax, and Medicare tax) and the actual total tax rate:

$110k income = $32,675.50 taxes = 29.71% tax rate

$150k income = $44,455.5 taxes = 29.64% tax rate

$300k income = $94,698 taxes = 31.57% tax rate

Uh oh, we broke it. Why is $150k-person paying a lower rate than $110k person? The answer is that the person earning $200k is paying exactly the same dollar amount in Social Security taxes, but since their income is higher their effective payroll tax rate is much lower than the rate of the person earning $110k. Once we get up to $300k we see that we're back in "higher earnings = higher tax rate" territory, although it might be reasonable to ask why the person earning almost three times as much as the $110k guy is paying a rate that isn't even 2% higher. For comparison, the jump from roughly $35k to $85k in earnings is commensurate with an effective tax rate increase of almost 7 percentage points:

$35,350 income = $7,571.78 taxes = 21.42% tax rate

$85,650 income = $23,994.73 taxes = 28.01% tax rate

Someone increasing their income from $35k to $85k is experiencing a much more significant and positive change in their quality of life and financial circumstances, and yet it seems that we're penalizing them more for this improvement than we are for someone jumping from $110k to $300k. Of course the point of taxes is not to punish people for earning money, and rather to fund government services of various kinds, but we should also be honest about the fact that taxes discourage the activity that they're tied to. This is more obvious with things like cigarette and gas taxes, but it also has some small impact on how much time people devote to work versus leisure. Why we are applying that discouraging tax rate increase more forcefully on those raising themselves from middle-class to upper-middle-class than we are from people moving from upper-middle-class to upper-class is something of a mystery to me. Weren't we supposed to be champions of the middle class?

You've probably figured out by now that I don't have any particular point I'm trying to make here. Hopefully you learned a little something about how the United States tax system works, and maybe have a slightly different perspective than you did before (or maybe a radically different one!). It's important that we do more than complain about the things we don't particularly like (i.e., taxes) and instead make an effort to better understand them and make educated decisions about how they should be changed. Maybe lower taxes are a good idea, but "lower taxes" doesn't tell us anything about who's paying less, how much less they're paying, or whether some people might be paying more to afford it. Additionally, how our institutions are organized is important. People will always argue about appropriate tax rates, but few would disagree that things aren't working properly when someone earning $150k a year pays a lower tax rate than another person earning $110k without even taking advantage of any of the numerous loopholes found in our tax system (which would take much more than this one post to discuss). Conversely, the advantages of a marginal tax rate system are self-evident: in actual dollars, people shouldn't pay more taxes than someone earning more than them.

If this post left any questions unanswered for you please let me know in the comment section. Chances are that I won't know the answer off-hand, but in the spirit of Better Institutions I'll be happy to learn the answer for myself and pass it along.

Subscribe to:

Posts (Atom)