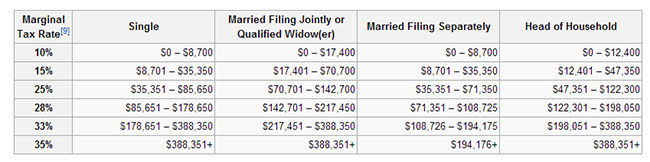

- Don't change the existing tax rates. Below is an image of our current marginal tax rates.

|

| From Wikipedia. |

- Add two new tax brackets: 40% for income above $1 million per year, and 45% for income above $5 million per year. Remember, this means that only income those thresholds is taxed at that amount--this does not discourage people from reaching these thresholds (at least, not if they understand how marginal tax rates work).

- Limit deductions for all individuals to ~$20,000 ($40k or less for couples), excluding charity and retirement investment. This means no excessive subsidies for "cadillac" health care plans, no writing off mortgage interest and property tax for multi-million dollar homes. The employer health care deduction is no longer necessary after Obamacare and should instead be offered to the employees themselves, and mortgage interest deductions primarily benefit the rich and are unnecessary to promote homeownership anyway. Charity is excluded because it's generally contrary to American values to discourage charity; retirement investment would not be subject to the $20k limit, although it would probably be sensible to limit it such that the very highest earners weren't receiving the bulk of the savings. Taking a look at our top tax expenditures, I estimate this would increase revenue by about $100-200 billion per year without negatively affecting anyone in the middle class (or very, very few). Limiting these deductions also ensures that people making similar incomes actually pay similar amounts of taxes, in lieu of all the distorting loopholes.

- Institute the Buffett Rule, slightly modified. Rather than limiting it to ensuring that people earning $1 million or more pay at least a 30% federal income tax rate, which might actually encourage people to limit their earnings, add a few more brackets. Say, 27% for those earning over $500k, and 25% for earnings over $300k. This takes care of people who earn the bulk of their money via investment and therefore pay at the 15% capital gains rate. It might also be reasonable to make a few brackets above 30%, like for example a 35% rate over $5 million.

That's it. The details are obviously negotiable. The principles behind this are: a) to ensure that the very rich are paying more, since it really makes no sense for someone earning $300k to pay the same rate as someone earning $10 million; b) to ensure that those earning less than ~$100k per year are not paying more as a result of these changes, and the deduction limits I proposed can be modified to reflect this; c) to ensure that no one in the upper income brackets is paying a lower rate than middle class Americans.

Republican politicians aside, these are principles that are wildly popular in the United States, and as long as it was made clear that the deduction limits are set highly enough so as not to negatively affect middle-income (or even upper-middle income) Americans, I think it could go over quite well. Besides having the effect of raising, at a very minimum, several hundred billion dollars a year in additional revenue, it gives us a system in which income is actually predictive of tax rate. No longer would we have people earning millions of dollars a year paying lower rates than those earning $50,000 or less, and no longer would the majority of tax expenditures accrue to the affluent.

Comments and criticisms appreciated--if I'm wrong about any of my assumptions, or if you think you've got better ideas about any of this, let me know! There're a million different ways to create a better system than what we're currently stuck with, this is just one possibility.

No comments:

Post a Comment